nanny tax calculator uk 2020

Negotiate a gross salary with your. This calculator assumes that you pay the nanny for the full year.

What Are Employer Taxes And Employee Taxes Gusto

This calculator assumes that you pay the nanny for the full year.

. Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans. Salary Workplace Pension Calculator 2018-19 Tax Year Enter Salary. NannyMatters have provided professional nanny payroll services and expert tax advice for parents since 2002.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. See where that hard-earned money goes - with UK income tax National Insurance student. For tax year 2021 the taxes you file in 2022.

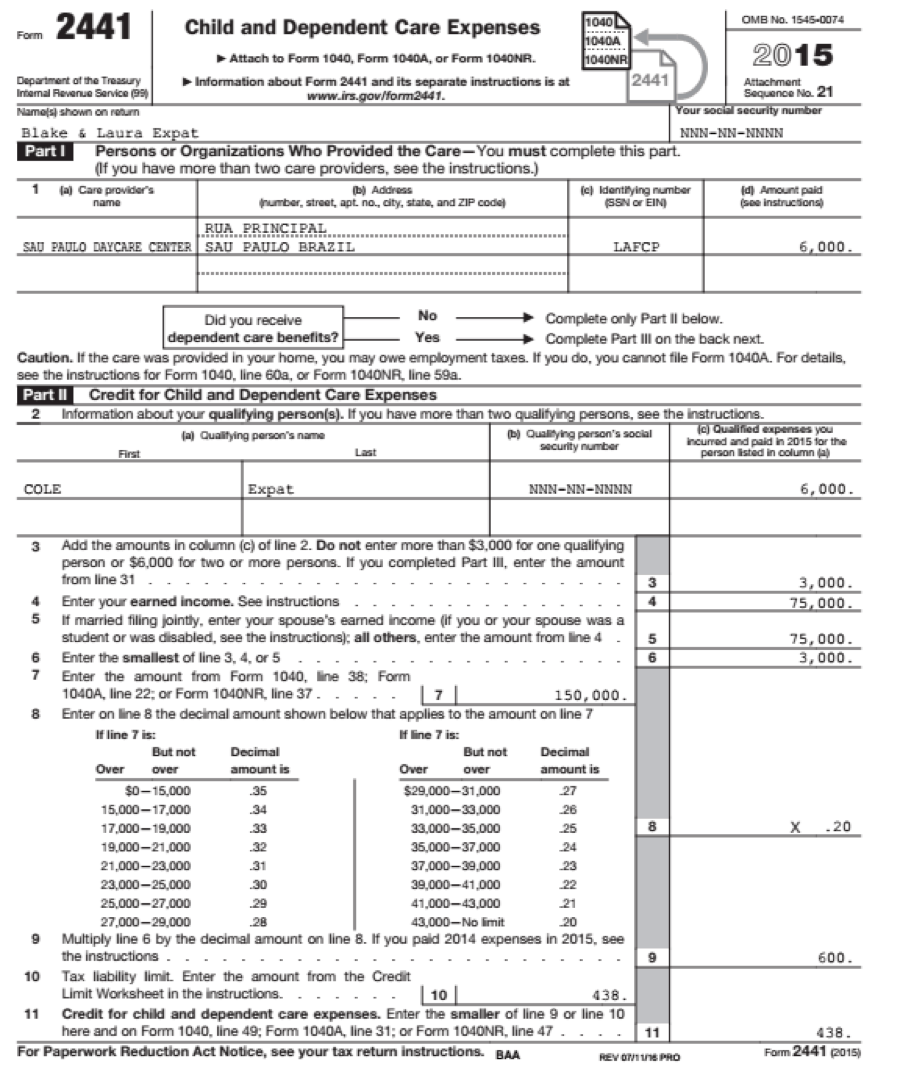

We go the extra mile to make sure you are properly looked after. Transfer unused allowance to your spouse. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two.

This is a sample calculation based on tax rates for common pay ranges and allowances. For an exact calculation based on salary actual tax code and employment status telephone our help desk. Written by Luke Harman.

Calculate your salary take home pay net wage after tax PAYE. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. The latest budget information from April 2022 is used to.

Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. Cost Calculator for Nanny Employers. Our nanny payroll service is paid for by your employer but you also get access to our experts at no charge to you.

For an exact calculation based on salary actual tax code and employment status telephone our help desk Mon Fri 0930 am 500 pm 020 8642 5470 or e-mail us at. The complete candidate document package will be submitted to you following the placement. Our new address is 110R South.

For an exact calculation based on salary actual tax. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year. Calculation is for April 2022 to.

This tells you your take-home. For a competitively priced annual fee we remove all the worry that can. Check your tax code - you may be owed 1000s.

Nannytax is the UKs nanny payroll market leader. Free tax code calculator. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

Select the tax code to use or specify other eg for a nanny share or more than one job calculations I confirm the calculation parameters as shown. Here is the IRS publication. Nanny tax calculator uk 2020.

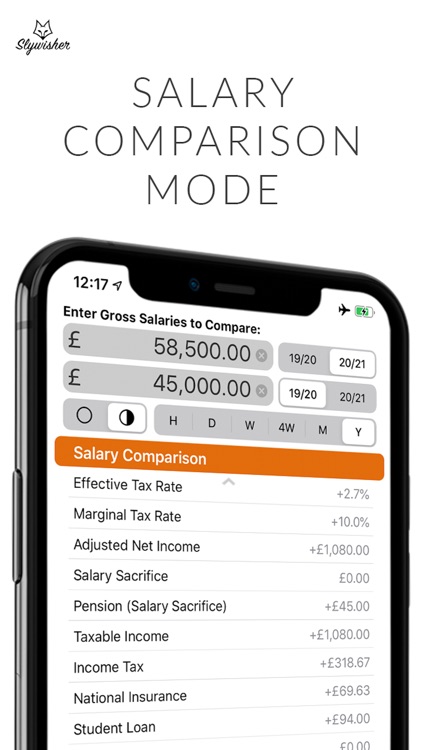

The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations. Updated for the 2022-2023 tax. Nanny tax calculator uk 2020.

However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. Ensure that the employee has the right to work in the UK. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

The Nanny Tax Company has moved. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household. This tells you your take-home.

11 income tax and related need-to-knows. Calculate your salary take home pay net wage after tax PAYE. Your individual results may vary and your results should not be viewed as a.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker.

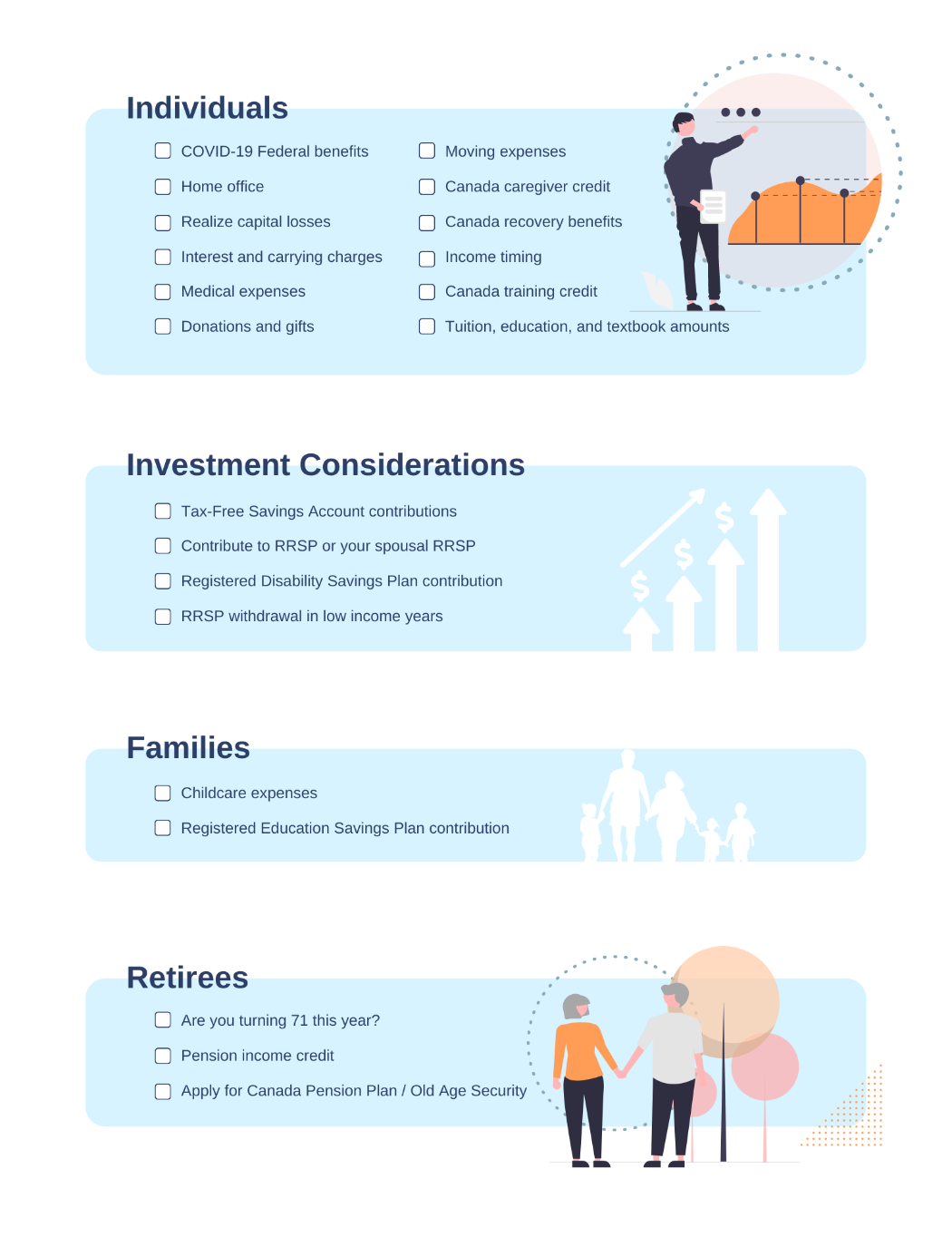

2021 Personal Year End Tax Tips Flci

Your Us Expat Tax Return And The Child Care Credit When Abroad

Why Does A System Of Low Taxes Work In Singapore But Not In The Uk Quora

Provision For Income Tax Definition Formula Calculation Examples

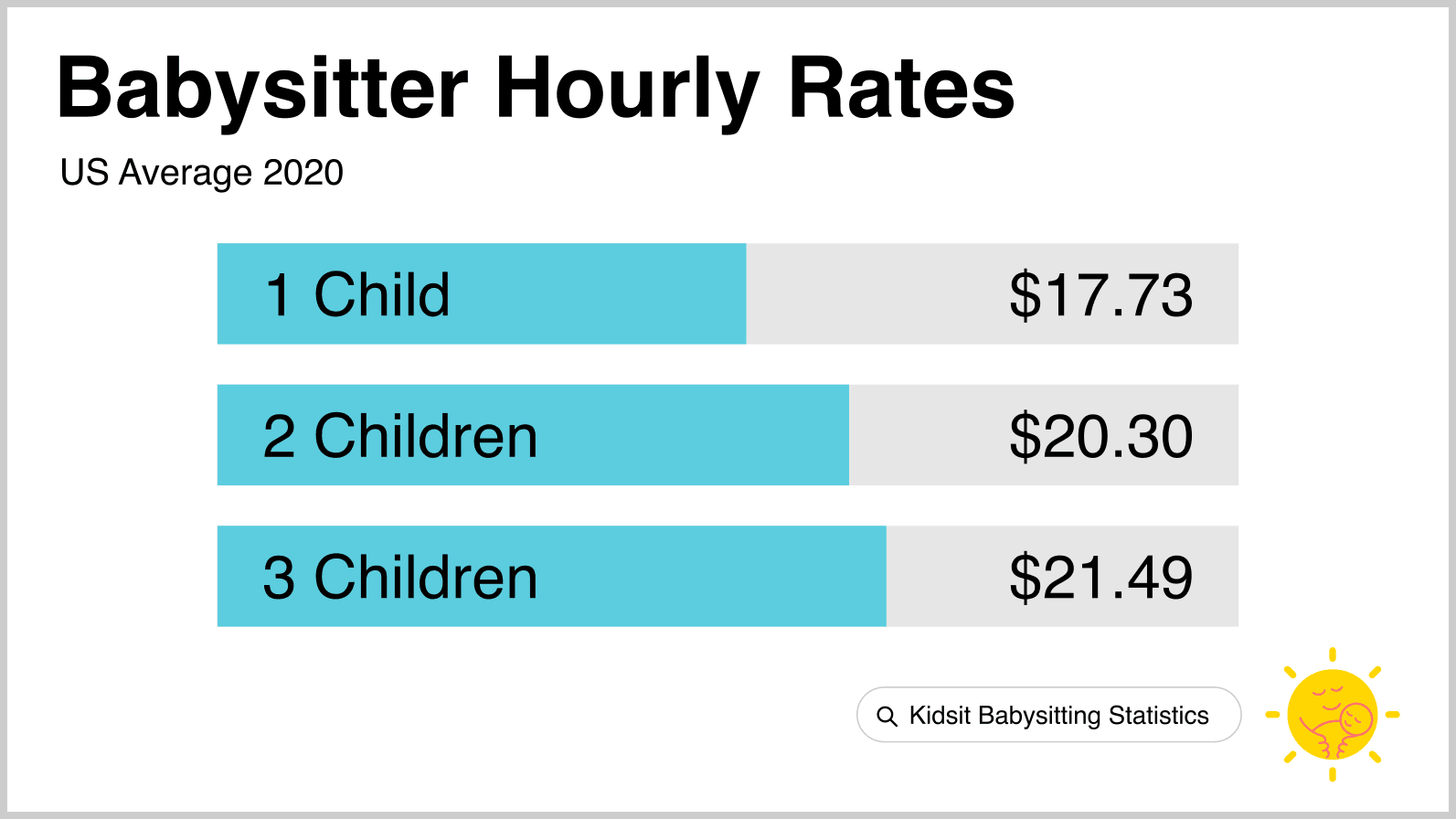

Babysitting Pay Rates How Much Should You Charge

Provision For Income Tax Definition Formula Calculation Examples

Corporate Tax Meaning Calculation Examples Planning

One Page Executive Summary Template Word In 2020 Executive Pertaining To One Page Busines Executive Summary Template Executive Summary Business Plan Template

Monthly Payroll Weekly Pay Vs Biweekly Bimonthly Pay Weekly Pay Vs Monthly

:max_bytes(150000):strip_icc()/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

The Top 15 Payroll Forms You Need When Running A Company In Usa

What Are Employer Taxes And Employee Taxes Gusto

Monthly Payroll Weekly Pay Vs Biweekly Bimonthly Pay Weekly Pay Vs Monthly

How To Do Payroll Yourself For Your Small Business Gusto

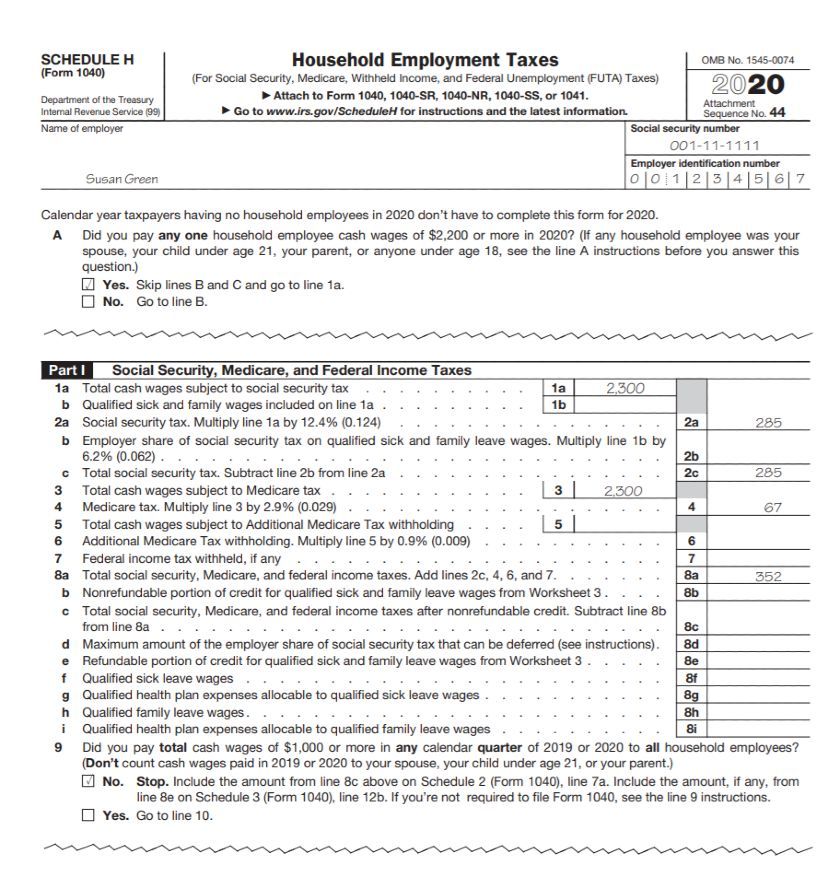

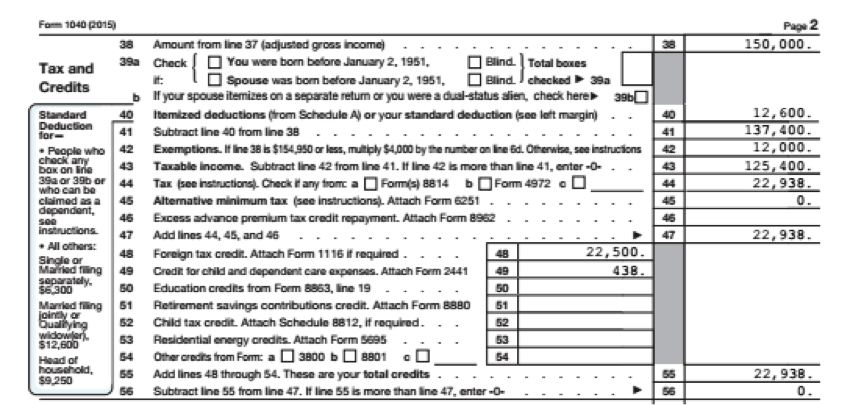

2016 Instructions For Schedule H Form 1040 Household Employment Taxes 2016 Instruction Internal Revenue Service Schedule

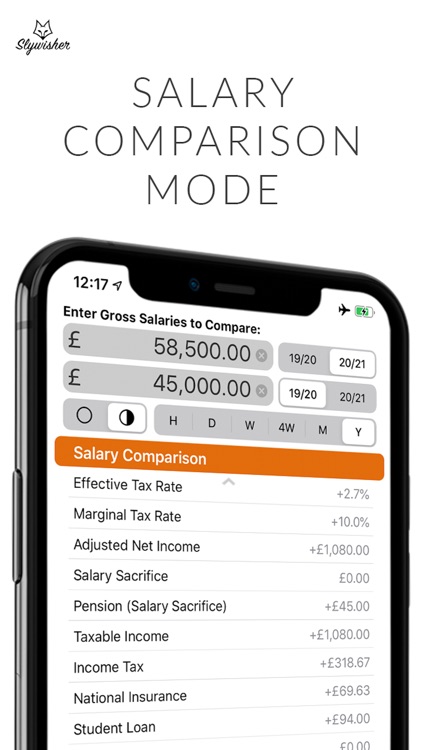

Uk Salary Calculator 2022 23 By Rhys Lewis

Your Us Expat Tax Return And The Child Care Credit When Abroad